Benny Landa’s LUSIX desires to succeed in a debt settlement with its collectors to stabilize the corporate after lab-grown diamond costs have fallen 90% on world markets.

Benny Landa’s lab-grown diamonds (LGD) producer LUSIX is anticipated to request a debt association after it failed to lift cash from current buyers led by LVMH (Louis Vuitton Moet Hennessey) Luxurious Ventures, in addition to Israeli buyers Extra Provident and Pension Funds, Maverick Ventures and Gabi Dishi’s Ragnar Crossover Fund and its accomplice Alpha Investments. Sources near Benny Landa say that the conflict has made it troublesome to search out buyers for the corporate. LUSIX has money owed of $15 million to Financial institution Leumi, Israel Low cost Financial institution and Amot Investments.

RELATED ARTICLES

LUSIX desires to succeed in a debt settlement with its collectors to stabilize the corporate and provides itself respiratory area for a number of weeks till it reaches an settlement with an Israeli worldwide chain of bijou shops in addition to agreements with current buyers on a restoration plan.

LUSIX has raised an estimated $150 million thus far embrace $60 million from serial entrepreneur Benny Landa’s Landa Group, which based it and $90 million from different main buyers led by LVMH. The corporate has been hit by the drastic fall in costs of lab-grown diamonds on the free market, because of enormous investments in it in India, which has made manufacturing in Israel unprofitable. Since India flooded the market with lab-grown diamonds, costs have fallen by greater than 90%.

Revealed by Globes, Israel enterprise information – en.globes.co.il – on August 18, 2024.

© Copyright of Globes Writer Itonut (1983) Ltd., 2024.

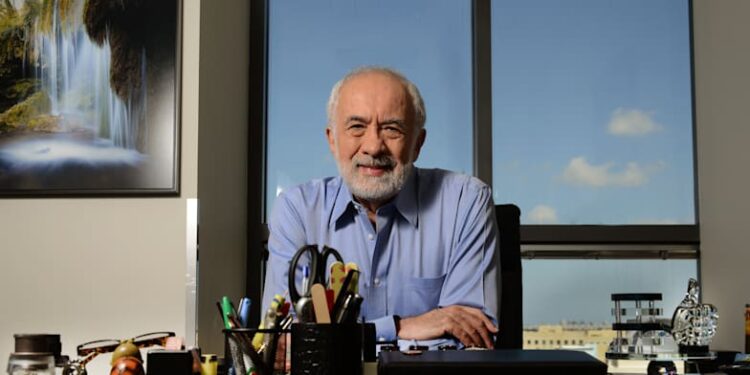

Benny Landa credit score: Eyal Izhar